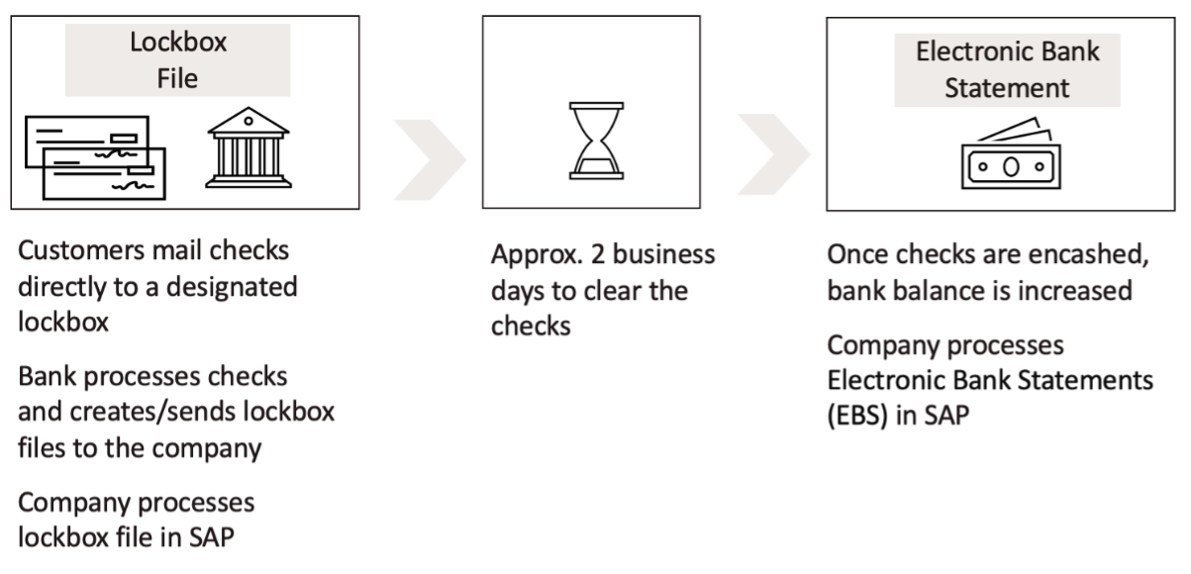

This is Part 1 of our blog series, where we explore the high-level business use cases of the Lockbox solution in SAP. We’ll discuss how Lockbox streamlines incoming payment processing and how it integrates with the Electronic Bank Statement (EBS).

What is Lockbox?

Lockbox is a widely used solution for processing incoming payments in the U.S., provided by major banks as part of their payment collection services. Instead of manually handling checks, customers send them directly to a designated lockbox. The bank processes these checks and provides a daily lockbox file to the company, ensuring faster cash flow and streamlined operations.

How Lockbox Works with the Electronic Bank Statement (EBS)

To fully automate incoming payments, some companies use Lockbox in conjunction with the Electronic Bank Statement (EBS) in SAP. Below, I will explain how they work together.

- EBS posts the total incoming checks amounts as a consolidated entry.

- Lockbox provides detailed line-item information for each incoming payment, such as invoice reference, customer name, check amount etc.

Steps Showing How EBS and Lockbox Work Together:

- Bank receives and deposits checks for the company. The bank processes incoming checks and deposits them into the company’s account. Below is a sample Lockbox file received on 06/01/2025:

2. Company receives and processes lockbox file in the SAP System. The Lockbox file includes check-level details. Based on the Lockbox configuration — which we’ll cover in a future blog post — SAP can be set up to handle postings in different ways, depending on specific business requirements. For this demonstration, we will use a two-step posting process:

3. Bank clears checks (~ within 2 business days. The banks are officially processed by the checks, and the funds are available in the company’s bank account

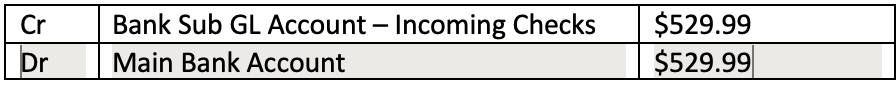

4. Company processes EBS in SAP. The Electronic Bank Statement (EBS) file reflects the total amount received from all checks as a single consolidated entry:

SAP Lockbox System Demo

In the following section, I will demonstrate how to process a lockbox file in SAP, using both the SAP GUI and Fiori Systems, based on the sample example provided above.

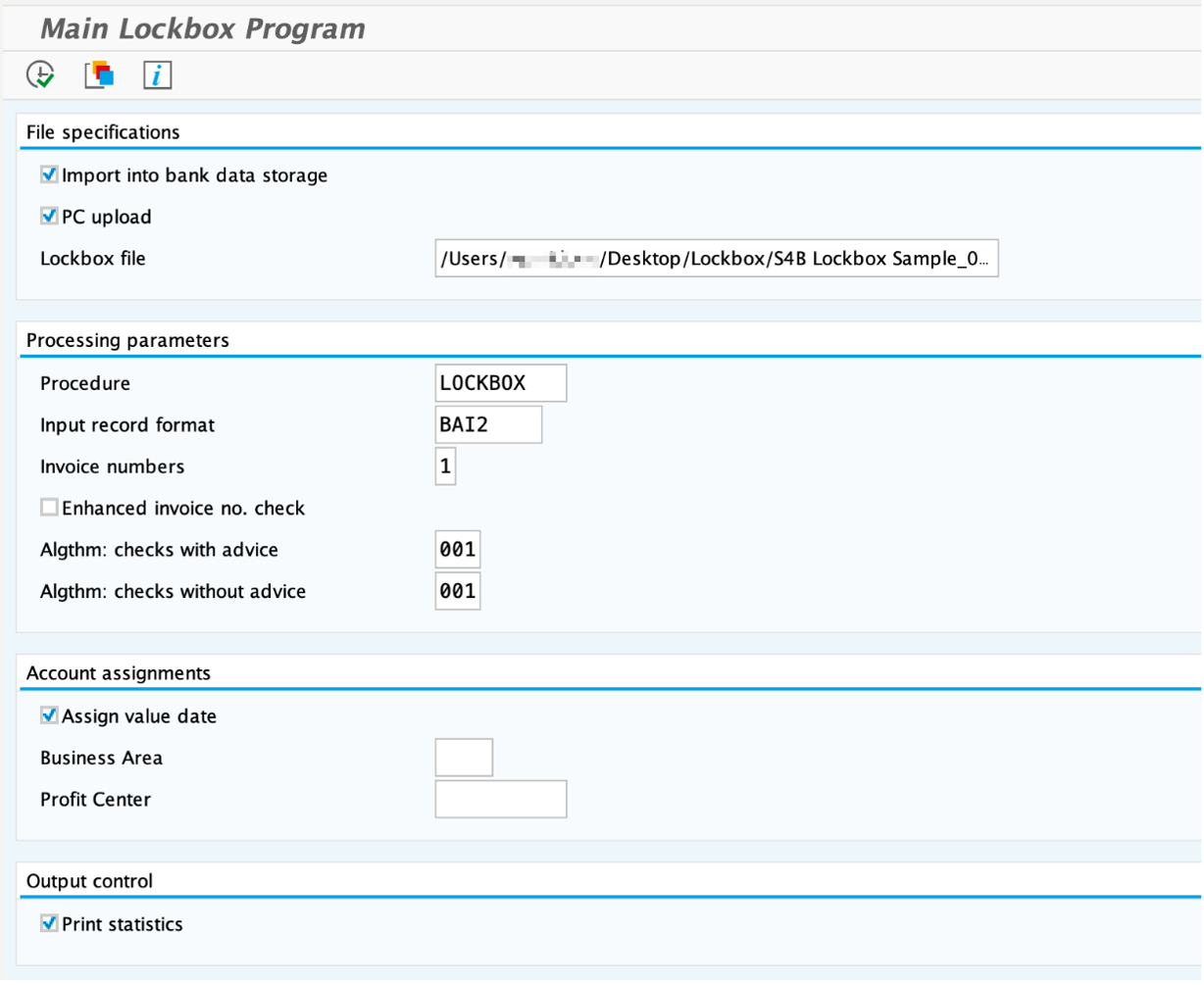

GUI system

To upload lockbox file, execute t-code FLB2 – Main Lockbox Program.

- Upload the Lockbox File in BAI2 format

- After “execution, 3 incoming checks are successfully applied to customer invoices.

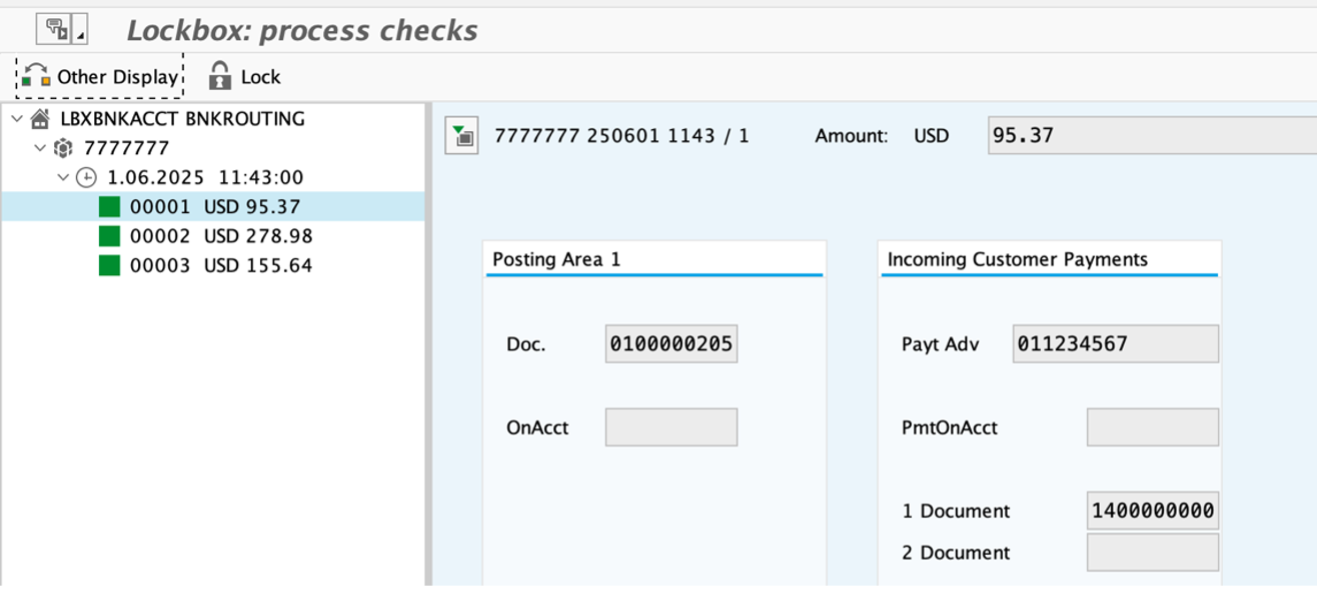

To review/post-process the checks, execute t-code FLB1 – Lockbox: process checks.

- 3 successfully processed checks (green status).

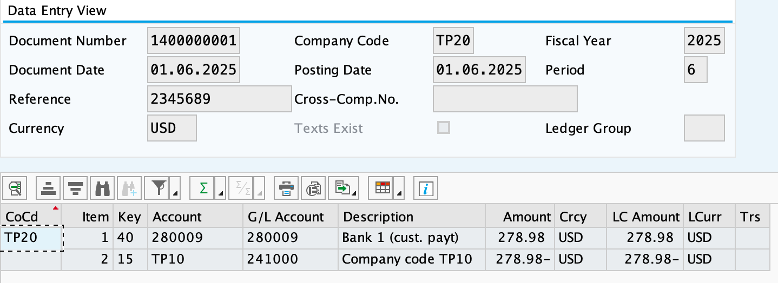

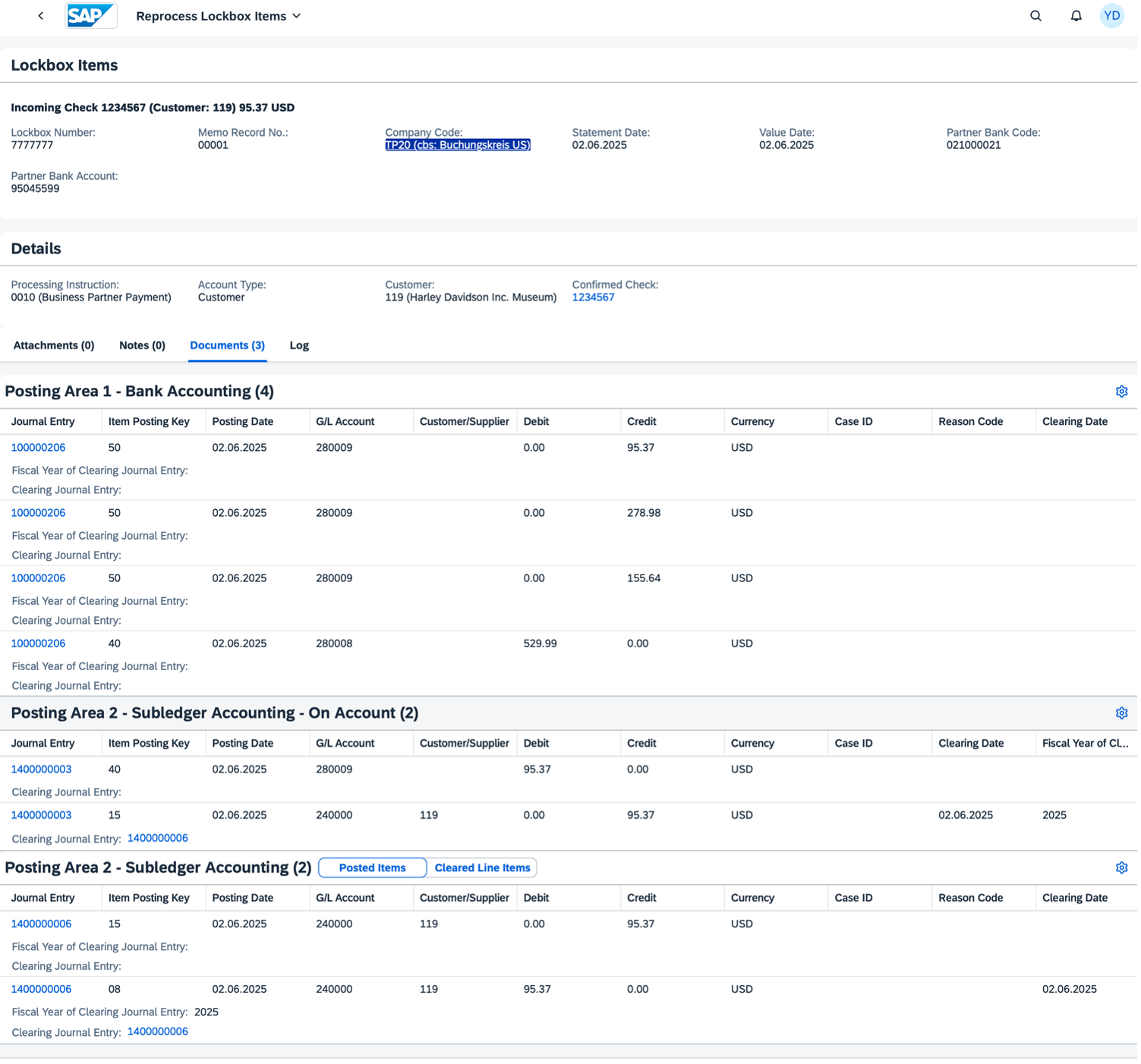

Following are the accounting postings in SAP:

- Posting Area 1: One posting per lockbox to the bank account (check total)

- Incoming Customer Payments

Fiori system

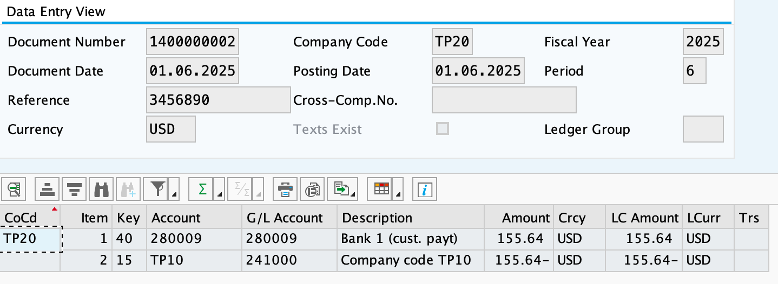

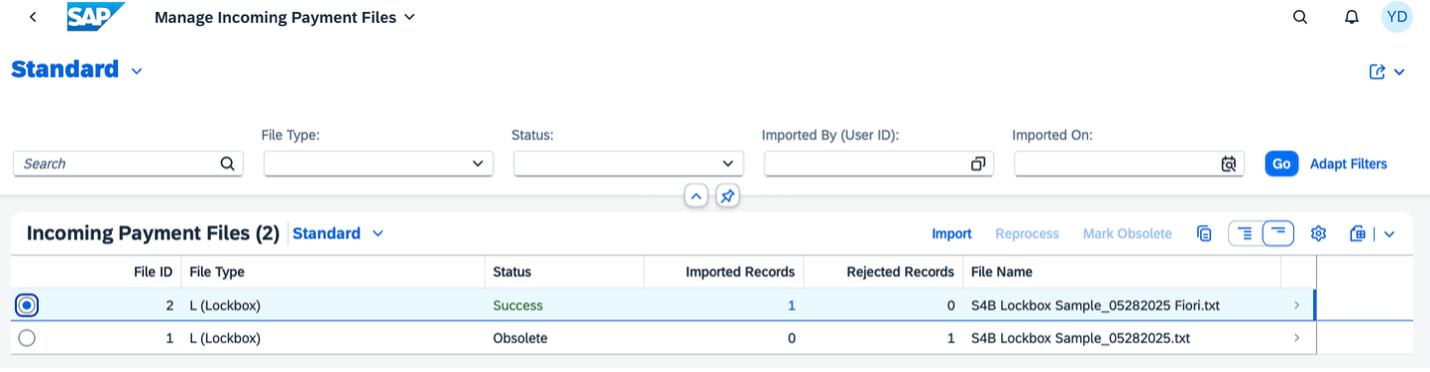

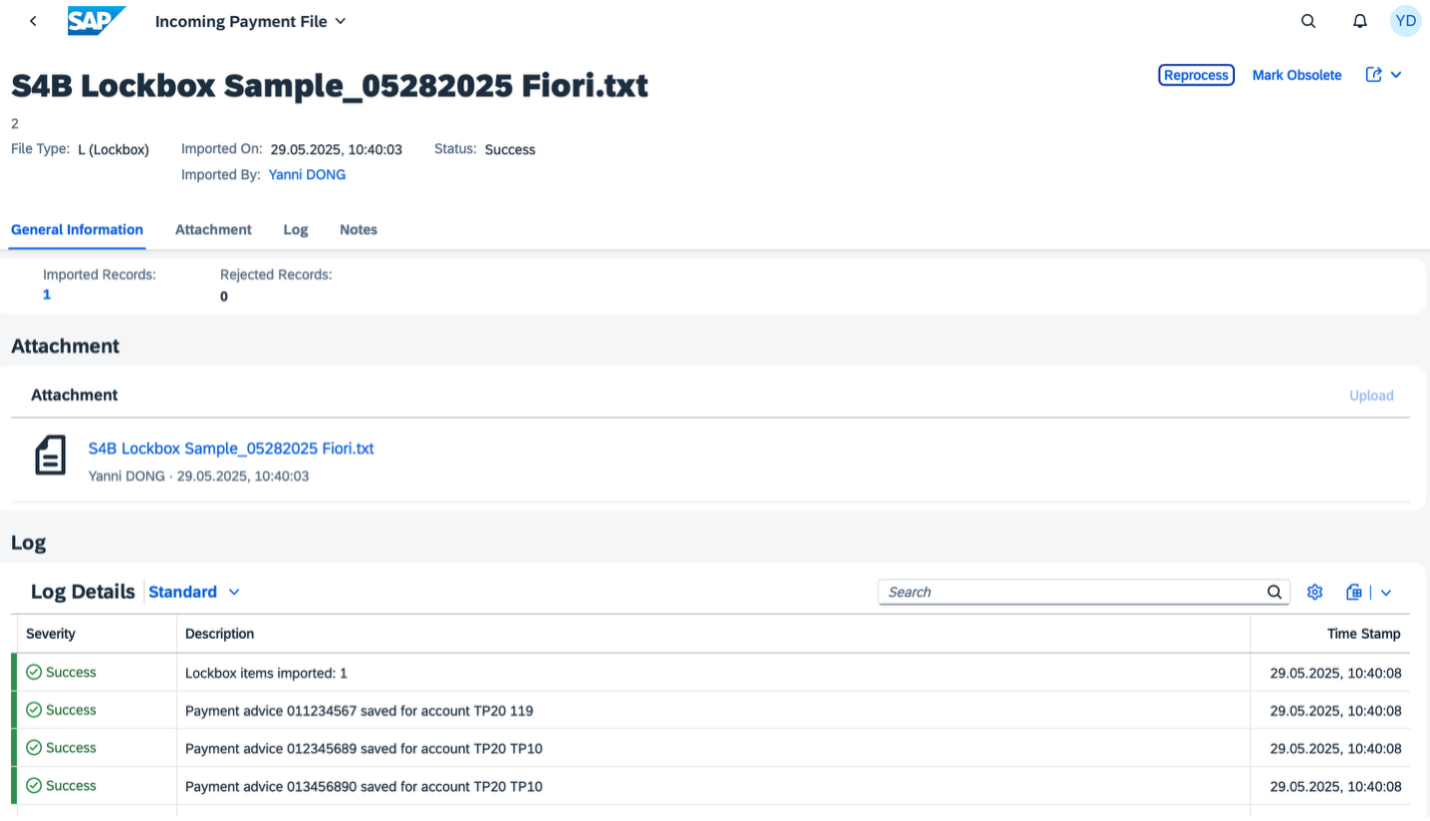

Similarly, we can also upload lockbox file via Fiori app “Manage Incoming Payment Files”.

- Click “import” button – “Lockbox Batch” to upload your file

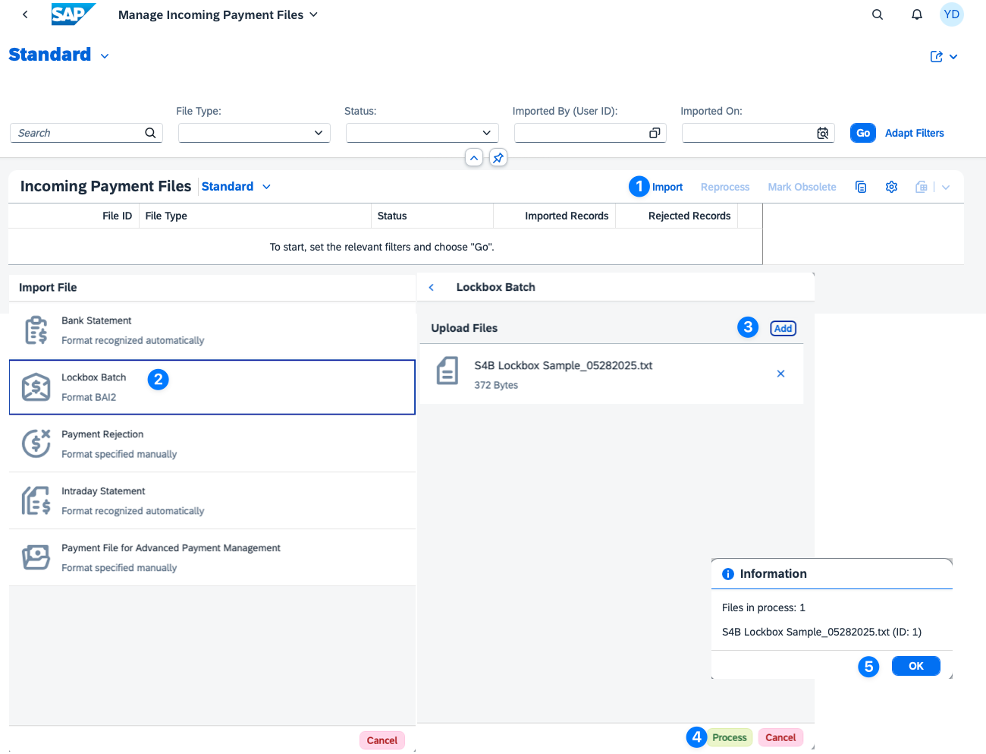

- The app gives you a nice overview of all the incoming payment files

- Drill in to see the upload details if needed

Fiori app “Manage Lockbox Batches” displays batches and individual checks details.

- In this case, all 3 checks have status “On Account” – customer IDs were found, but invoices couldn’t be fully matched.

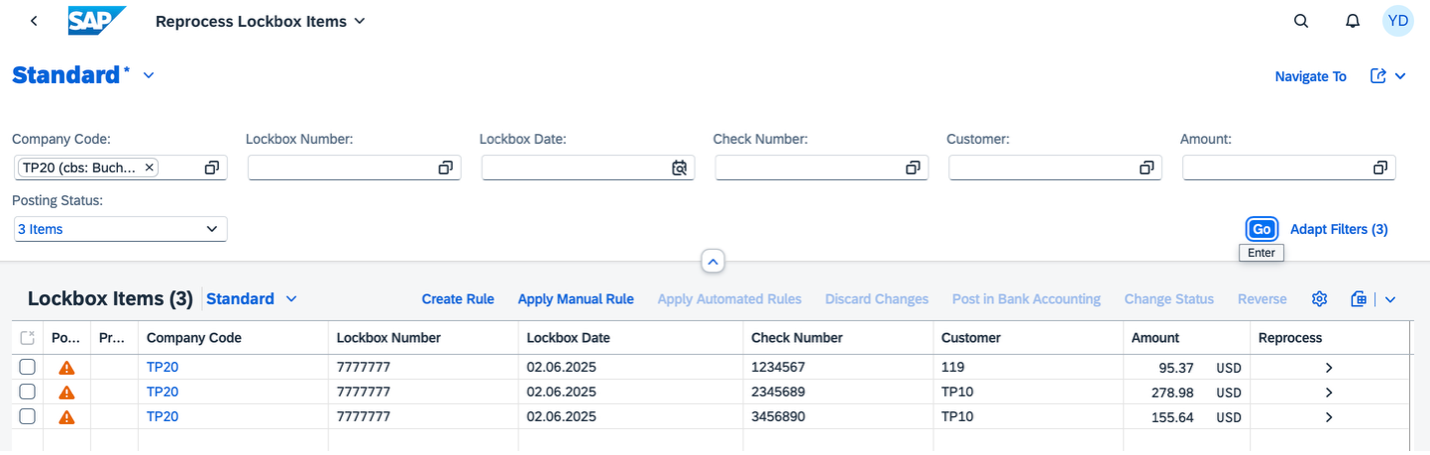

In this case, access Fiori app “Reprocess Lockbox Items” to review/postprocess the checks, similar to t-code FLB1 – Lockbox: process checks.

- Manually assign open invoices

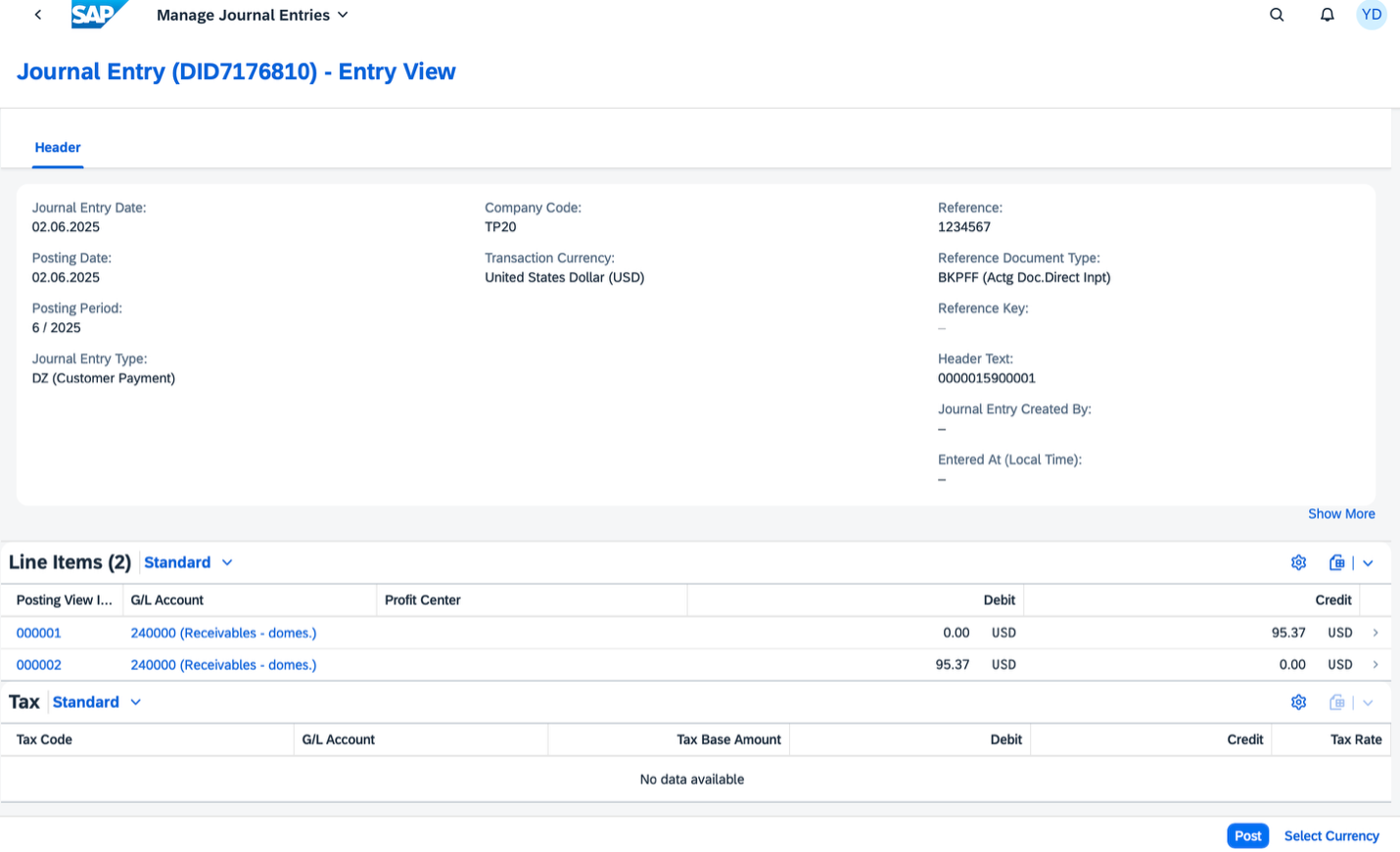

- Simulate the Journal Entry

- Overview of the accounting impacts

Summary

- Lockbox ensures detailed customer payment application, while EBS supports high-level bank reconciliation.

- The two-step Lockbox posting ensures accuracy and control over customer receivables.

- EBS simplifies reconciliation by consolidating multiple checks payments into one single bank entry