In the current business world, knowing whether a customer will pay on time is critical. Late payments can disrupt cash flow, increase credit risk, and cause financial instability. Classifying customers’ credit risk as good or bad based on payment history can help identify potential payment issues and take proactive measures to mitigate them. For example, information can be used to adjust credit terms, request partial payment upfront, or even decline orders from customers with a history of late payments. These will be made more accessible with the aid of process automation, which cuts down manual efforts and increases the Purchase Order release rate. It will undeniably improve the cashflow management and result in an efficient workflow of Accounts Receivable. To understand more, please continue to read below.

Introduction

In the current business world, a common practice of accounts receivable as the following:

- Generating and sending invoices to customers: Once a sale is made, the company generates an invoice (proof of delivery/services) and sends it to the customer.

- Recording invoices: The invoices are recorded in the company’s accounting system to keep track of the amounts owed by customers.

- Recording payment receipts: When the customer pays the invoice, the company records the payment in its accounting system to update the customer’s account balance.

- Follow-up on unpaid/overdue invoices: If the customer does not pay the invoice on time, the company follows up with the customer to collect payment.

- Reconciliation of customer accounts: The company reconciles the customer accounts to ensure that all payments are properly recorded, and that the customer’s account balance is accurate.

- Aging analysis: The company analyses the age of outstanding customer invoices to determine which invoices are overdue and require follow-up.

- Bad debt provision: The company may need to make a provision for bad debts, which is an estimated amount of money that is unlikely to be collected from customers.

The accounts receivable process involves generating and sending invoices to customers, recording invoices and payment receipts, following up on unpaid invoices, reconciling customer accounts, conducting ageing analysis of outstanding invoices, and making provisions for bad debts if necessary. This process helps companies keep track of amounts owed by customers and ensure accurate accounting of payments. So, what might be potentially a challenge?

What are the pain points of the current Account Receivable process?

The current accounts receivable process faces several pain points. Firstly, there is a lack of visibility into the status of accounts receivable, making it challenging to prioritise collections and manage cash flow efficiently. Secondly, late or delinquent payments can negatively impact cash flow and profitability. Lastly, the process of collecting payments from customers is often time-consuming and costly, involving numerous follow-ups and collection efforts.

- Lack of visibility: Companies may lack visibility into the status of their account receivable, which can make it challenging to prioritise collection efforts and manage cash flow effectively.

- Late or delinquent payments: Late or outstanding payments can have a significant impact on a company’s cash flow and profitability.

- Time-consuming: Collecting customer payments can be a time-consuming and costly process involving multiple follow-ups and collection efforts.

SAP Signavio and SAP Build Process Automation – How Does It Help?

SAP Signavio, in combination with SAP Build Process Automation, can provide synergy to significantly improve the current account receivable process with a high degree of automation, efficiency, and effectiveness.

SAP Signavio is a software suite to design, analyse and improve business processes and manage process changes. In addition, the solution makes it possible to monitor the success of process adjustments in the long term. It consists of different solutions for various stages of business process management:

- For process analysis and mining stage: SAP Signavio Process Intelligence, SAP Signavio Process Insights

- For process and journey modelling stage: SAP Signavio Process Manager, SAP Signavio Journey Modeler

- For workflow and automation execution: SAP Signavio Process Governance

On the other hand, SAP Build Process Automation, one of SAP BTP services that allows citizen developer solutions to adapt, improve and innovate business processes with no-code workflow management and robotic process automation capabilities, to achieve the hyper-automation, which is the concept of automating everything in an organisation that can be automated, in SAP and non-SAP systems.

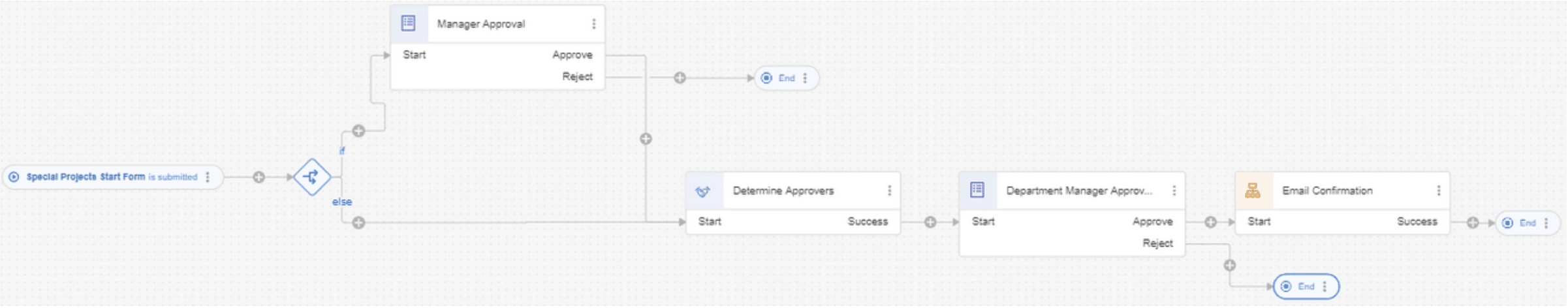

Together, SAP Signavio provides insights into the process bottleneck in the account receivable process, and SAP Build Process Automation can be used to trigger automated resolution from SAP Signavio for the classification of bad and good credit, automatic reminders to notify customers of overdue invoices via SAP Build Process Automation. An approval workflow can be triggered to manage customer credit limit and customer credit blocks if needed. This helps to streamline business operations and reduce manual effort and errors.

The Benefits

Benefit – 1: Improving cash flow.

By identifying potential payment issues ahead of time, we can take proactive measures to ensure timely payments and improve cash flow.

Benefit – 2: Reducing credit risk.

By classifying customers based on payment history, we can identify high-risk customers and take measures to mitigate credit risk, such as adjusting credit terms and requesting partial payment upfront.

Help clients prioritise collections efforts and focus on the customers more likely to pay on time, while also avoiding the risks associated with doing business with customers more likely to default.

Benefit – 3: Enhancing customer relationships.

By addressing potential payment issues proactively, we can improve customer satisfaction and build stronger relationships.

With SAP Signavio, we can identify the root causes of payment delays or delinquencies, such as product quality issues, pricing disputes, or communication breakdowns, which can be addressed to improve customer satisfaction and prevent future payment problems.

Benefit – 4: Streamlining business operations.

We can streamline their business operations and reduce manual effort and errors by automating the classification process using SAP Signavio and SAP Build Process Automation in seamless and integrated enterprise architecture.

For Efficiency, Traceability, and Productivity!

With SAP Signavio Process Manager, we would design the business process model following the process flows to gauge the recommendable measures to mitigate the risks.

With SAP Signavio Process Intelligence, we would trigger the process automation via SAP Build Process Automation to realise hyper-automation solutions with efficient process flow, such as acting on the classification of bad and good credit, automatic reminders to notify customers, approval workflow to manage the customer credit limits.