Welcome to Part 3, the final post of the blog series on SAP Lockbox solution. Now that we’ve covered the business use case and technical setup in previous posts, let’s explore how payment differences can be effectively managed within Lockbox.

Managing Payment Differences with Lockbox

How should payment differences be posted in SAP?

Handling payment differences varies based on business requirements:

- Within Tolerance Limits:

- If the difference is minor, the system can automatically adjust it by applying a cash discount or posting the variance to a designated gain/loss account.

- Exceeds Tolerance Limits:

- If the difference exceeds the predefined limits, the system processes it as a partial payment or creates a residual item for the outstanding amount.

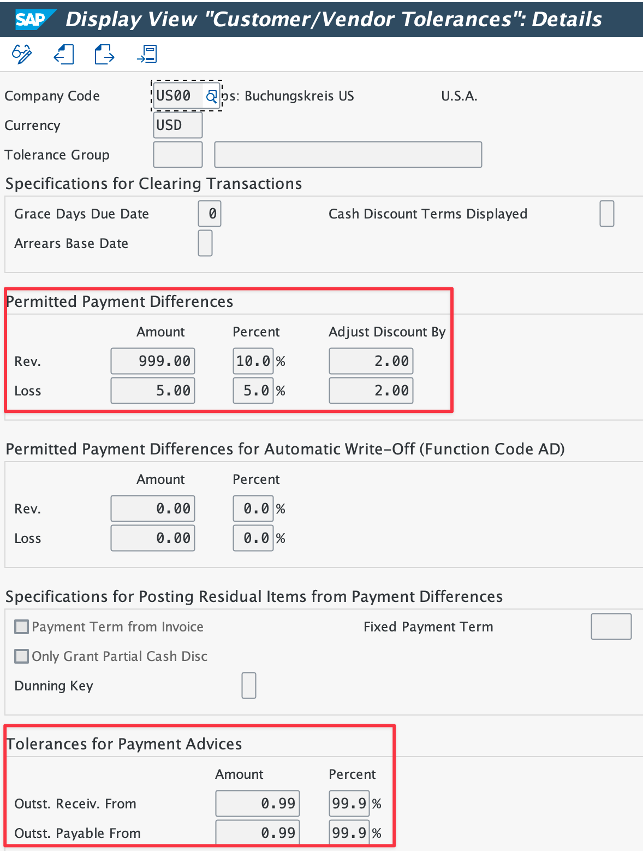

What tolerance limits can be set in SAP for customer payment differences?

SAP provides two key configuration settings to define payment tolerances:

- OBA4 – Define Tolerance Groups for Employees

- OBA3 – Define Customers/Vendor Tolerances (the focus of this blog)

OBA3 – Define Customers/Vendor Tolerances

In transaction OBA3, two types of tolerance limits can be configured:

- Tolerances for Payment Advice (Individual Invoice Level):

This checks the difference between the payment advice (the amount the customer intends to pay) and the actual amount owed for each invoice. - Permitted Payment Differences (Total Level):

After evaluating individual invoices, the system checks the overall difference between the total amount paid and the total outstanding balance.

Real Life Scenario: Managing Payment Differences with Lockbox

Let’s consider a practical example. Imagine you run a business, and customers send checks to your company’s lockbox to pay their invoices. However, the payment amounts they send don’t always match the exact amounts owed. The SAP Lockbox solution helps manage these discrepancies efficiently.

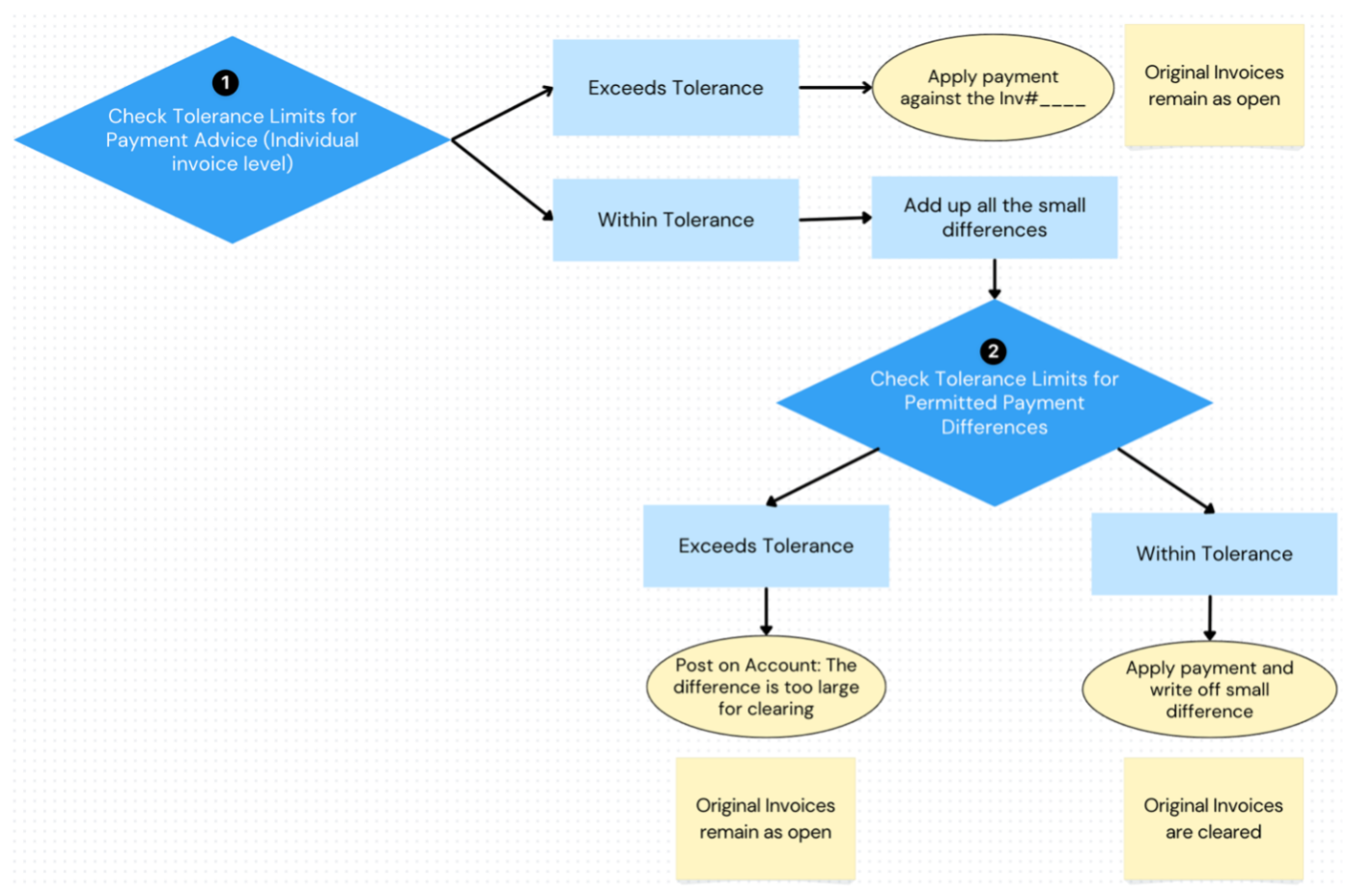

Step 1: Invoice-Level Comparison with Payment Advice

(Defined under “Tolerances for Payment Advice section)

- The system first reviews each invoice individually, comparing: Payment advice (the amount the customer intends to pay) vs. Actual invoice amount owed

- If the difference exceeds the tolerance limit: The system applies the payment but doesn’t clear the invoice. The remaining balance stays open.

- If the difference is within the limit: The system adds up small differences across invoices to determine the overall discrepancy.

Step 2: Evaluate the Total Payment Difference

(Defined under “Tolerances for Payment Advice section)

- If the total difference exceeds the tolerance limit:

- The system posts the payment to the customer account but does not clear the invoices. Manual post-processing is required.

- Example: if the customer owes the company a total of $100, but he/she only pays $30. The system would apply $30 to the customer account, but the remaining balance of $70 remains as open (can be set up as either partial payment or residual item per business’s requirement)

- If the total difference is within the tolerance limit:

- The system clears the invoices automatically and writes off the small discrepancy. The books for those invoices are considered settled.

- Example: if the customer owes the company a total of $100, but he/she is short of $0.50 and only paid $99.50. The system says “Okay, this is close enough” and write off the $0.50 and clear the open items on customer’s account.

Note:

If the tolerance limits for payment advice exceed the defined threshold, the system will automatically apply the payment against the invoice with an “Apply” status. In this case, it will not proceed to check the limits for permitted payment differences.

As you review the posting examples, please refer back to this flowchart to ensure that each step aligns with the process logic.

SAP Lockbox Payment Differences Examples

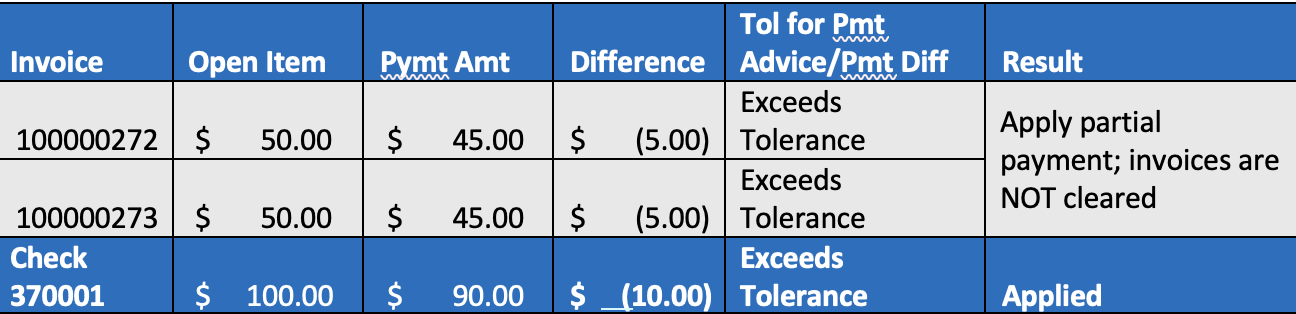

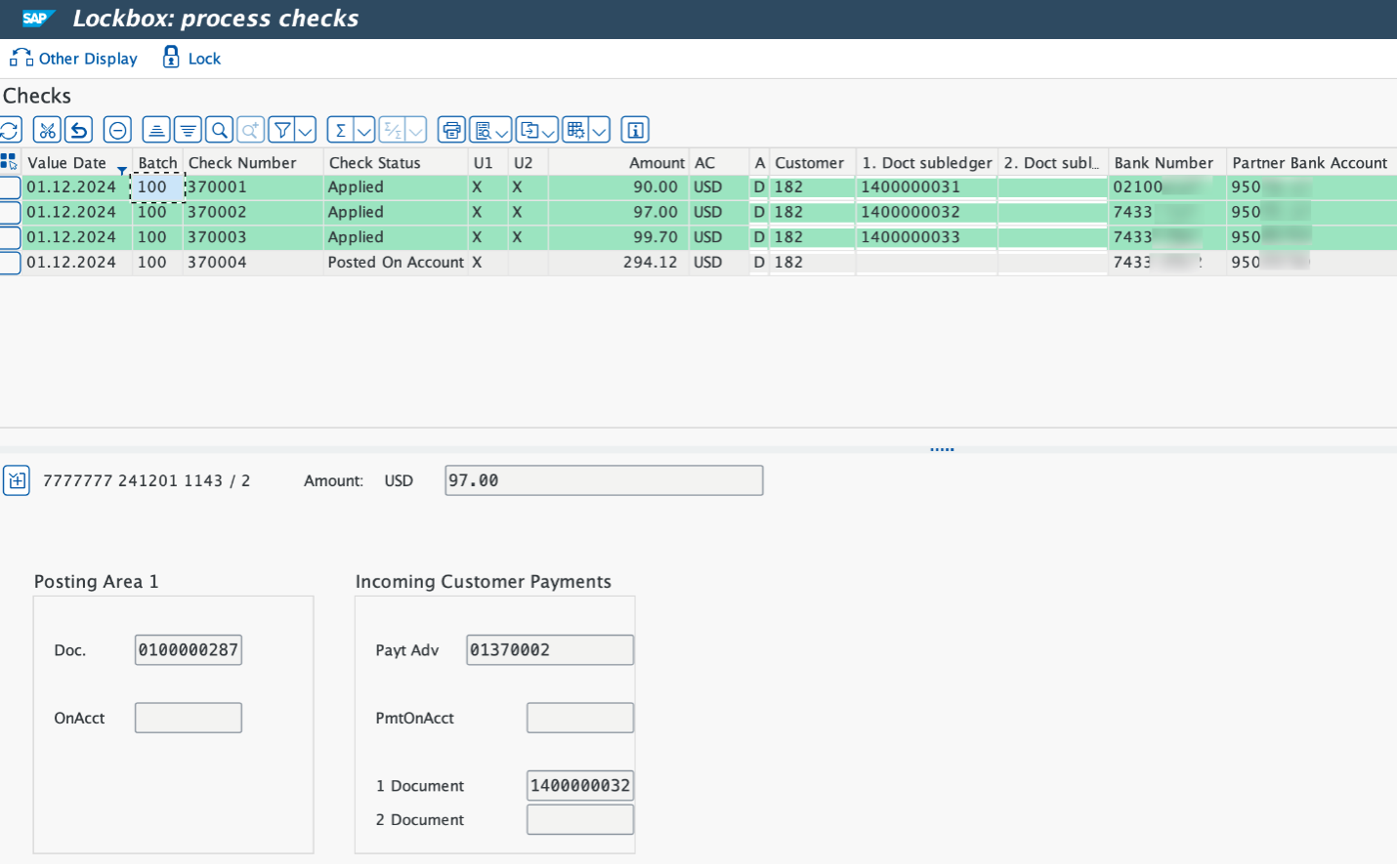

Example 1:

In this example, we received a total of $90 for check 370001 from customer to pay against the open invoice 100000272 ($50) and 100000273 ($50). The system first check at the payment advice (individual invoice level) and determined that it exceeds the tolerance limits for the payment advice ($0.99) as shown in the figure 2. so, the system applies the payment against that specific invoice but doesn’t close it.

→ Check Status: Applied

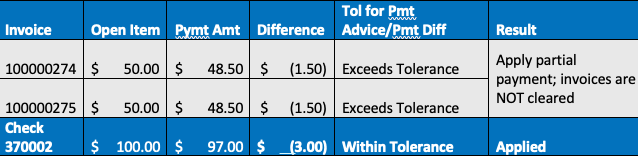

Example 2:

Like example 1, the system first check at the payment advice (individual invoice level) and determined that it exceeds the tolerance limits for the payment advice ($0.99) as shown in the figure 2. So the system applies the payment against that specific bill but doesn’t close it.

→ Check Status: Applied

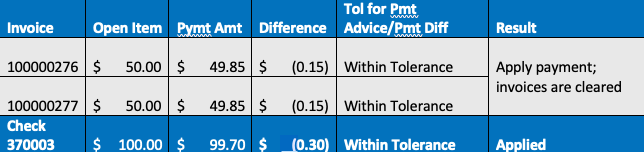

Example 3:

In this example, we received a total of $99.70 for check 370003 from customer to pay against the open invoice 100000276 ($50) and 100000277($50). The system first check at the payment advice (individual invoice level) and determined the difference is only off by $0.15 per invoice (within the tolerance limits for the payment advice). So the system moves on and add all the small differences together to look at the overall total level. In this case, the overall payment is only off by $0.30 (within permitted payment differences per figure 2). So the system writes off the small difference as “not a big deal” and closes the books for those bills.

→ Check Status: Applied

Example 4:

Like Example 3, the system first check and determined the difference is close enough at the payment advice (individual invoice level), so it moves on to the second step, adding all the small differences together. In this case, the overall payment is $5.88 off compared to the open items, which exceeds the $5 tolerance limits for the permitted payment difference. The system posts the incoming payment under the customer account but doesn’t clear the bills. A postprocessing is required.

→ Check Status: Post on Account

Conclusion

The SAP Lockbox solution provides a powerful way to automate payment processing, reduce manual intervention, and ensure accurate financial postings. By leveraging tolerance settings, businesses can handle minor discrepancies efficiently while flagging significant issues for review.