How finance leaders can move from technology curiosity to operational value.

1. Why AI matters most in finance today?

Modern finance teams are under increasing pressure to deliver fast, accurate insights in a world of rapid change; while also maintaining compliance, managing liquidity, and operating more efficiently than ever. Artificial Intelligence (AI), when applied to specific finance use cases, is proving to be a critical enabler in meeting these expectations.

Recent industry studies highlight two key trends:

- A growing number of finance functions are adopting AI for forecasting, reporting, and treasury management optimization.

- However, only a limited subset of these organizations actively measure the value created by AI. Without systematic measurement, it is difficult to know where AI truly delivers results, highlighting that its impact depends on the specific use cases and how they are executed.

This is why the conversation among finance leaders has shifted. The question is no longer “Does AI work?” but rather “Where can it create the most strategic value?”

2. AI in Finance: Moving from technology hype to targeted impact

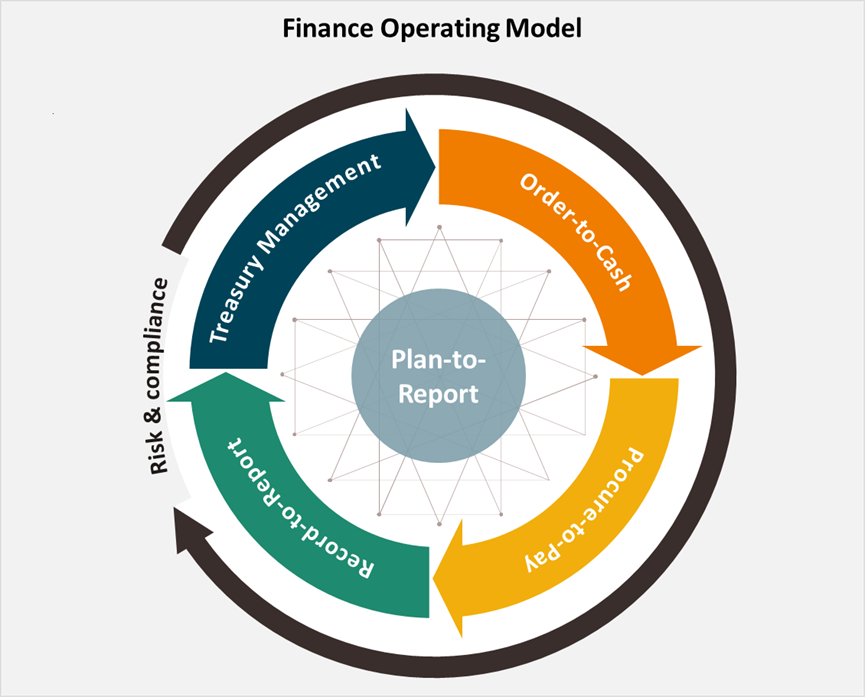

AI’s value becomes tangible when applied across key finance processes. Each area presents a unique opportunity for AI to enhance transparency, automate routine tasks, and support more data-driven decision-making.

The Finance Operating Model below illustrates the core process clusters, the very areas where AI creates tangible business impact.

2.1. Order-to-Cash (O2C): Enhancing receivables management

The O2C process is central to managing receivables and ensuring strong cash flow. When integrated into O2C, AI can uncover customer payment behaviors, reduce billing inaccuracies, and help prioritize collections based on risk insights.

- Predictive modeling to segment customers by payment behavior

- Early detection of invoice errors and transactions likely to lead to disputes

- Improved DSO forecasting using advanced behavioral and risk analytics

- More accurate forecasting of cash inflows

- Smarter prioritization of collection activities

- Fewer disputes thanks to early identification of billing issues

2.2. Procure-to-Pay (P2P): Driving efficiency and cost discipline

The P2P process is a key area where finance can realize meaningful improvements in cost control and operational efficiency. AI plays a pivotal role by identifying anomalies, streamlining invoice processing, and aligning payment timing with both liquidity and supplier management strategies.

- Automated invoice matching and intelligent coding to reduce manual input

- Detection of duplicate payments and real-time fraud monitoring

- Predictive payment scheduling and Days Payable Outstanding (DPO) optimization

- Significant reduction in manual effort tied to invoice processing

- Improved consistency in meeting payment terms

- Increased transparency into cash obligations and supplier exposure

2.3. Record-to-Report (R2R): Enabling faster, more reliable financial closes

The R2R process is foundational to delivering timely and accurate financial statements. AI enhances this process by improving efficiency, minimizing manual touchpoints, and reinforcing data integrity throughout the reporting cycle. Through exception-based automation, finance teams can achieve faster and more consistent period-end closes.

- Recommending accruals and deferrals based on recurring transaction patterns

- Detecting reconciliation mismatches using advanced anomaly detection

- Predicting closing delays by analyzing historical workload and trends

- Higher standardization across entities and business units

- Fewer manual adjustments during the close process

- Earlier identification of reconciliation issues, improving reporting accuracy

2.4. Plan-to-Report: Elevating precision and agility

Among finance processes, planning and forecasting have emerged as some of the most advanced applications of AI. By integrating non-linear drivers and adapting dynamically to new data, AI improves forecast accuracy and makes scenario planning significantly more responsive and agile.

- Leveraging machine learning models to forecast revenue, margins, and costs

- Incorporating external variables such as economic indicators or pricing data

- Supporting variance analysis through interpretable and explainable models

- More robust and reliable forecasting outputs

- Shorter forecast cycles, freeing up finance resources

- Improved ability to simulate scenarios and respond to changing market conditions

2.5. Treasury management: Strategic liquidity planning

Treasury functions are increasingly turning to AI to improve their visibility into cash positions, anticipate short-term funding needs, and enable more strategic decision-making around investments and financing.

- Cash flow forecasting using transactional data for both short- and mid-term horizons

- Modeling disbursement and collection behaviors to anticipate liquidity movements

- Simulating foreign exchange and interest rate risks across multiple market scenarios

- Improved liquidity management enabled by more accurate cash forecasts

- Greater confidence in making timely investment and funding decisions

- A shift from reactive treasury operations to proactive, forward-looking planning

2.6. Risk & compliance: Proactive risk management

AI is helping finance functions shift from reactive oversight to proactive risk management. By continuously monitoring transactions and identifying anomalies as they occur, AI enhances internal controls and supports more reliable, data-driven regulatory compliance.

- Real-time scanning of transactions to detect policy violations

- Predictive alerts to flag potential control breakdowns before they escalate

- Instant validation of tax codes and compliance thresholds during processing

- Faster and more accurate detection of compliance risks

- Consistent enforcement of internal controls across the organization

- Improved audit readiness through automated tracking and traceability

3. What enables AI success in finance

While the potential of AI in finance is clear, not every initiative delivers measurable value. Industry research consistently shows that success is less about the sophistication of the algorithm, and more about how well the initiative is executed.

AI Success Enablers:

- Disconnected or inconsistent data structures across systems

- Lack of specialized finance-AI talent within the organization

- Siloed ownership of end-to-end finance processes

- Limited model explainability, leading to low stakeholder trust

- Clearly defined use cases underpinned by strong value logic

- High data maturity, supported by strong governance practices

- Cross-functional collaboration between finance, IT, and data science

- Iterative delivery models focused on measurable outcomes and business impact

4. Conclusion: Turning AI potential into practical value

AI presents a significant opportunity for finance organizations to enhance efficiency, accuracy, and alignment with broader business goals. The real value of AI lies in the measurable results it delivers at the process level, not in the technology itself.

By deploying AI in high-impact areas like forecasting, treasury management, financial close, and compliance, CFOs can reposition the finance function from a transactional role to a true strategic partner.

Is your finance team ready to move beyond pilot projects and into performance?

We work with finance leaders to identify high-value use cases, develop clear execution roadmaps, and deliver results that matter. Let’s discuss at how AI can generate lasting value within your finance organization.